Business

What is Financial Modeling For Business

Financial modeling is a crucial tool in the world of finance and business that involves creating a mathematical representation or simulation of a company’s financial performance. This representation is typically constructed in spreadsheet software and aims to provide a comprehensive view of the company’s past, present, and projected financial situation. Financial modelling is essential for making informed decisions, setting strategic goals, and understanding the potential impact of various scenarios on a company’s finances.

Key Highlights

Here are some key highlights of financial modeling:

1. Forecasting and Planning: Financial models help businesses forecast their future financial performance, allowing them to plan for growth, budget effectively, and set realistic financial goals.

2. Valuation: Financial models are used to determine the value of a company or an investment opportunity, helping investors make informed decisions.

3. Risk Assessment: They enable the assessment of financial risks by modeling various scenarios and identifying potential vulnerabilities in a company’s financial structure.

4. Decision-Making: Financial models play a pivotal role in decision-making processes, such as capital allocation, mergers and acquisitions, and investment evaluations.

5. Communication: They serve as a communication tool, helping stakeholders, including investors, lenders, and management, understand a company’s financial health and future prospects.

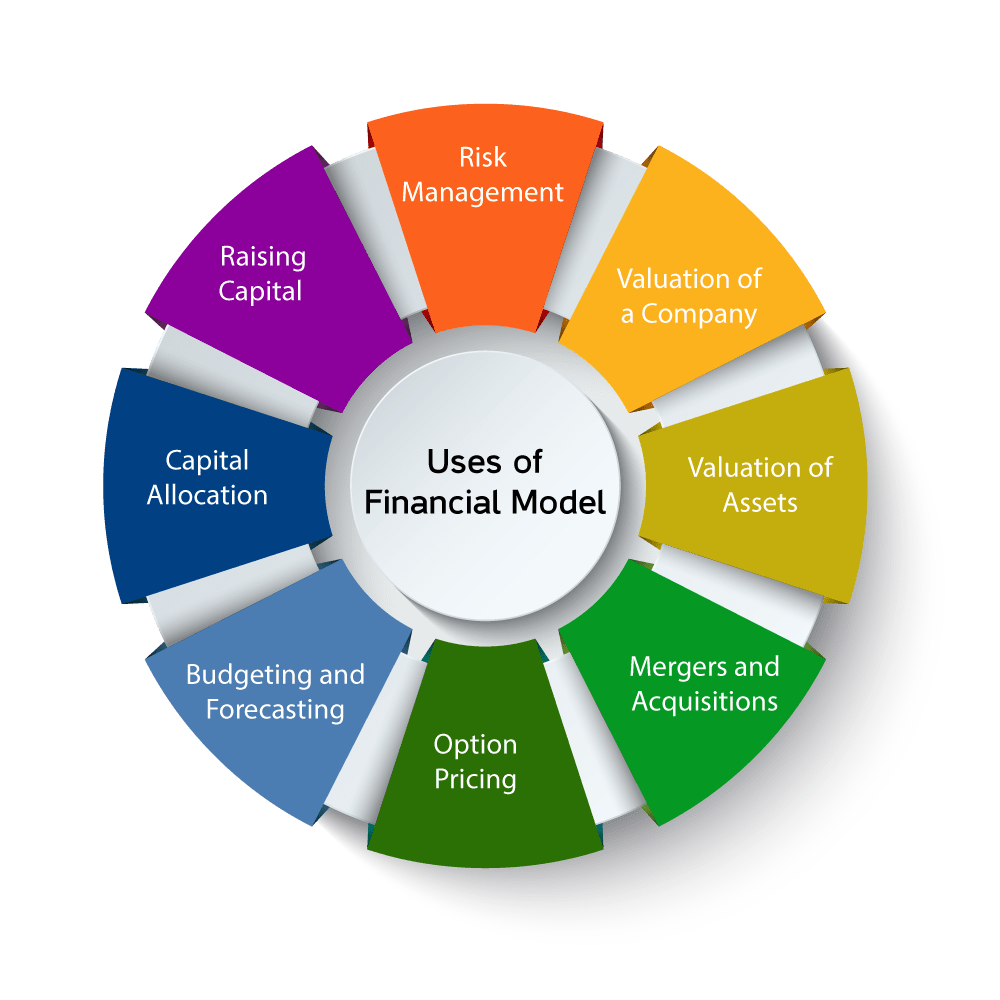

What is a Financial Model Used For?

Financial models serve various purposes, including:

Budgeting and Planning: To create budgets and financial plans for the short and long term.

Valuation: To determine the value of a company or an investment.

Investment Analysis: To evaluate the potential return on investment (ROI) of various projects or investments.

Risk Management: To assess financial risks and develop strategies to mitigate them.

Scenario Analysis: To model different scenarios and understand their potential impact on financial outcomes.

What Software is Best for Financial Modeling?

Several software options are suitable for financial modeling, with Microsoft Excel being the most widely used. Other popular tools include Google Sheets, specialized financial modeling software like Quantrix, and industry-specific software for tasks such as real estate modeling.

Who Builds Financial Models?

Financial models are typically built by finance professionals, including financial analysts, investment bankers, corporate finance managers, and consultants. These individuals have the expertise to collect data, make assumptions, and create accurate and comprehensive financial models.

How Can You Learn Financial Modeling?

You can learn financial modeling through various avenues:

Formal Education: Pursue a degree in finance, accounting, or business, which often includes financial modeling courses.

Online Courses:

]Enroll in online courses and certifications offered by reputable institutions and platforms, such as the FMVA® Program.

Self-Study: Utilize books, online resources, and practice to develop your financial modeling skills.

Mentorship: Seek guidance from experienced finance professionals who can provide hands-on training.

How Much Accounting Knowledge is Required for Financial Modeling?

A strong understanding of accounting principles is essential for financial modeling. You need to be proficient in areas such as financial statement analysis, accrual accounting, and financial ratios.

However, the depth of accounting knowledge required may vary depending on the complexity of the modeling task and the industry you are working in.

Additional Resources

Analyst Certification FMVA® Program: Consider enrolling in the FMVA® Program to gain in-depth knowledge and certification in financial modeling and valuation.

Additional Questions & Answers

For more detailed information and answers to specific questions about financial modeling, you can visit the Riverstone Training website or consult their educational materials and courses.